The Texas Hotel Performance Research 2018 Annual Report, a publication created by JLL Hotels & Hospitality and commissioned by Travel Texas, notes the state’s highest level of hotel room revenue on record, which was buoyed by robust corporate travel, solid demand for group and conventions business, and leisure travel.

The report depicts hotel performance analysis for the state’s metropolitan areas and 25 largest cities based on the analysis of hotel room revenue figures reported to the Texas Comptroller.

The Comptroller’s dataset is augmented by JLL Hotels & Hospitality, a fully-integrated platform with expertise in hospitality trends across the U.S. and key industry indicators, and knowledge of tourism and visitor trends, to provide an up-to-date report on the state’s hotel industry performance. To request a copy of the latest Travel Texas Industry Research reports, complete the form available online here.

Robust corporate travel, solid demand for group and conventions business, and leisure travel driven by consumers’ increased focus on experiences rather than material purchases, combined to help the State of Texas record strong hotel room revenue performance in 2018.

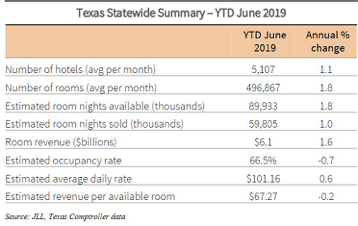

The first half data in 2019 suggests that the state’s hotel lodging performance continues to be strong. New hotel openings and increased revenues at existing hotels in H1 resulted in a 2.4% increase in room revenue during the second quarter of 2019 compared to 2018, and revenue per available room (RevPAR) increased 1.4% in the three months ending June 2019.

2018 Performance

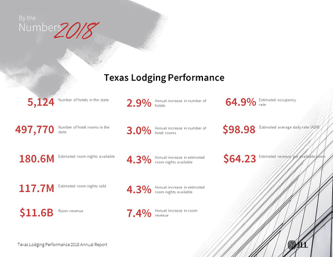

In addition to posting a 4.3% increase in the number of available room nights in the state, 2018 represented the ninth consecutive year of positive growth in statewide RevPAR.

Overall, the state posted an estimated occupancy rate of 64.9% for the year, slightly lower than the national occupancy level of 66.2 %, a record high. The state’s hotel supply grew 2.9% and room supply increased by 3.0%. Hotels in Texas collected more than $11.6 billion in room revenue during the year.

Texas’ major markets’ performance in 2018 varied, a trend in line with the country. The state is in the ninth consecutive year of economic increases; however, the underlying rate of growth has started to slow and become more uneven.

The Austin-Round Rock market continues to be one of the top growing hotel markets in the country, with hotel property performance and hotel development growth matching the considerable population increases and rising corporate activity.

However, the market’s room supply increases have depressed hotel operating performance for two consecutive years, as supply deliveries outpaced the rise in room night demand. According to figures analyzed from the Comptroller, Austin recorded a 0.7% decrease in RevPAR in 2018, as occupancy rates declined. But even with decreasing occupancy, operators were able to drive room rate growth by 1.5%, indicative of the relative strength of the economy and hotel market demand.

Similarly, the Dallas-Fort Worth market has seen sustained growth in hotel openings, given the strong demographic trends in the market.

While RevPAR was constrained in 2017, notwithstanding a further decrease in occupancy due to the supply deliveries, hotel operators in the market were able to boost average room rates by 5.0% in 2018, which was twice the national average. The robust room rate growth is being driven by strong corporate travel spend, healthy group and conventions activity, and sustained leisure travel demand.

By contrast, 2018 was a year of normalization for the Houston-The Woodlands-Sugarland market. Among the 10 largest hotel markets in the U.S., Houston’s hotel market was marked by considerable swings in 2017 and early 2018, given the February 2017 hosting of Super Bowl LI and the impact of Hurricane Harvey in late August of that year. Due in part to the difficulty of underwriting hotel asset value in a period of notable fluctuations in performance, Houston saw relatively tepid hotel transactions activity in 2018.

Performance in the First Six-months of 2019

The positive trends exhibited in 2018 continued through the first half of 2019. Given the increase in room supply and hotel operators’ ability to maintain average daily rates, total room revenue year-to-date June 2019 was $6.1 billion, an increase of 1.6% over the same period in 2018. Overall occupancy in the state softened year-to-date June (posting a 0.7% decline), due in part to supply growth outpacing demand in some of the state’s larger markets (e.g. Dallas-Fort Worth).

Texas Hotel Performance Research

These and other data points were collected in the Texas Hotel Performance Research 2018 Annual Report, a publication created by the JLL Hotels & Hospitality and commissioned by Travel Texas.

The report depicts hotel performance analysis for the state’s metropolitan areas and 25 largest cities based on the analysis of hotel room revenue figures reported to the Texas Comptroller. The Comptroller’s dataset is augmented by JLL Hotels & Hospitality, a fully-integrated platform with expertise in hospitality trends across the U.S. and key industry indicators, and knowledge of tourism and visitor trends, to provide an up-to-date report on the state’s hotel industry performance. Reports are provided to Travel Texas on a monthly, quarterly, and annual basis, and provide data to compare hotel lodging performance on a month-over-month, a year-to-date and full-year level.

Since the first Texas Hotel Performance Research Annual Report submitted by JLL in 2015, reporting has focused on the aggregate performance of hotels with 30 or more rooms. This accounts for approximately 95.0% of units and revenues, reported in the texas.gov data.