June 29, 2019

Justin Bragiel, THLA General Counsel

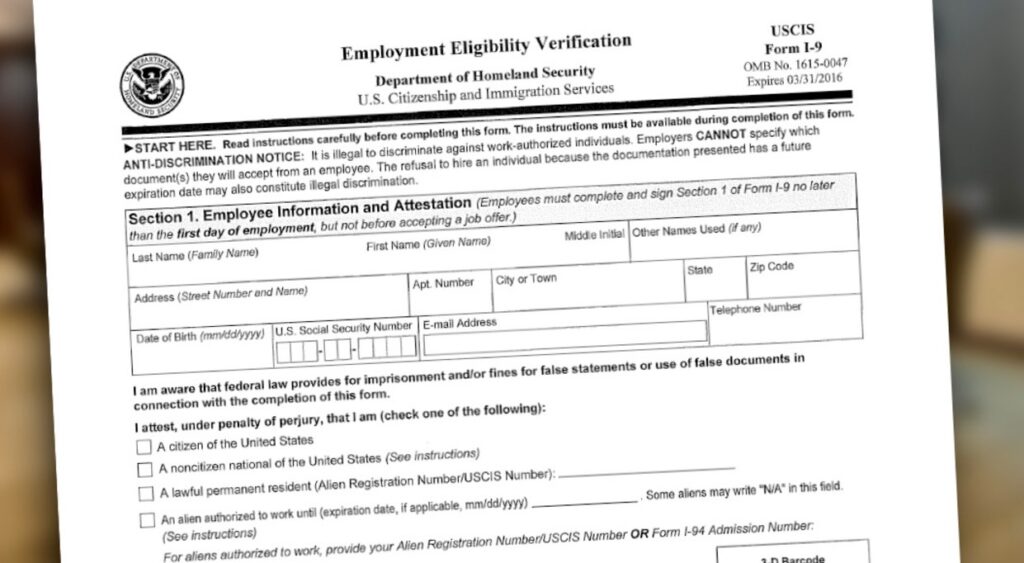

In the last week, the Trump Administration’s Immigration and Customs Enforcement (ICE) has stepped up I-9 audits of businesses across the U.S., and a number of Texas hotels have reported receiving notices that ICE officials intend to inspect records in the coming month.

If you have a specific reason to be concerned regarding the ICE notice, we suggest you call a THLA attorney right now at 512-474-2996. Otherwise, if you receive such a notice, consider the following:

1. Gather all I-9 Forms on file. The employee must make any corrections to the forms, and have the employee

2. Obtain I-9 forms for current employees who are missing I-9’s. This must be filled out by the employee.

3. Gather all of the audit forms and I-9’s of current employees. The employer must make any corrections to these and initial and date beside any correction.

4. Go through each I-9 and correct errors or discrepancies.

5. Finally, gather all of

When making corrections, you cannot use white out or liquid paper. If you keep copies of the I-9 supporting documents, you will need to gather and produce them to ICE, as well. It is normal for ICE to request I-9 forms for terminated employees in the last year. ICE should have also requested some additional documents and information, including an employee list, payroll documents, and business owner information, gather those and have them ready.

Other hoteliers should take note: ICE audits may be coming to you. Here is how to get ready:

1) Stay Organized

In the event that you receive a notice from ICE or the Department of Homeland Security to submit your forms for inspection, you’ll have only three days to comply. If agents physically appear at your hotel with a valid warrant (more on that later), you’ll have to provide them immediately. Failure to meet these timelines can result in a fine of $1,100 for each form you’re unable to furnish.

While you are permitted to keep either paper or electronic copies of your I-9s, you may want to consider digital records. The ease with which you can sign, search for, and audit forms stored digitally simply makes it a more practical option for growing companies.

Either way, remember that you’ll need to maintain forms for current and even terminated employees. Once an employee departs, keep their form on record for three years after their hire date, or one year after they leave—whichever comes later.

2) Run Internal I-9 Audits

There is no better way to stay compliant than to regularly run self-audits of your Form I-9s. While that may seem daunting, especially for larger companies with hundreds if not thousands of records, it’s well worth the effort. At the very least, consider making it an annual habit.

To get started, pull a headcount report and cross-reference it with the forms on file. Before looking for common errors, prioritize cases where forms appear to be missing altogether. Once you’ve identified who might be missing a form, take action immediately. Explain the situation to the affected individuals and ask them to complete a new form and bring their supporting documents into the office, preferably by the next day. Do not backdate the form to the employees’ original hire date. Note that if an employee can’t provide supporting information, you’ll either have to part ways with them or place them on unpaid leave until the matter is resolved.

Once you’ve addressed any missing forms for current employees, check for potentially expired forms. For individuals who aren’t citizens or permanent residents, you’ll need to continually re-verify their work authorization as their supporting documents expire.

Further Assistance:

If you have questions about I-9 audit procedures, do not hesitate to contact a THLA attorney at 512-474-2996.

IMPORTANT NOTES: